Article in the “Business Insider” on Russia’s emergency fund: One of Russia’s biggest economic problems

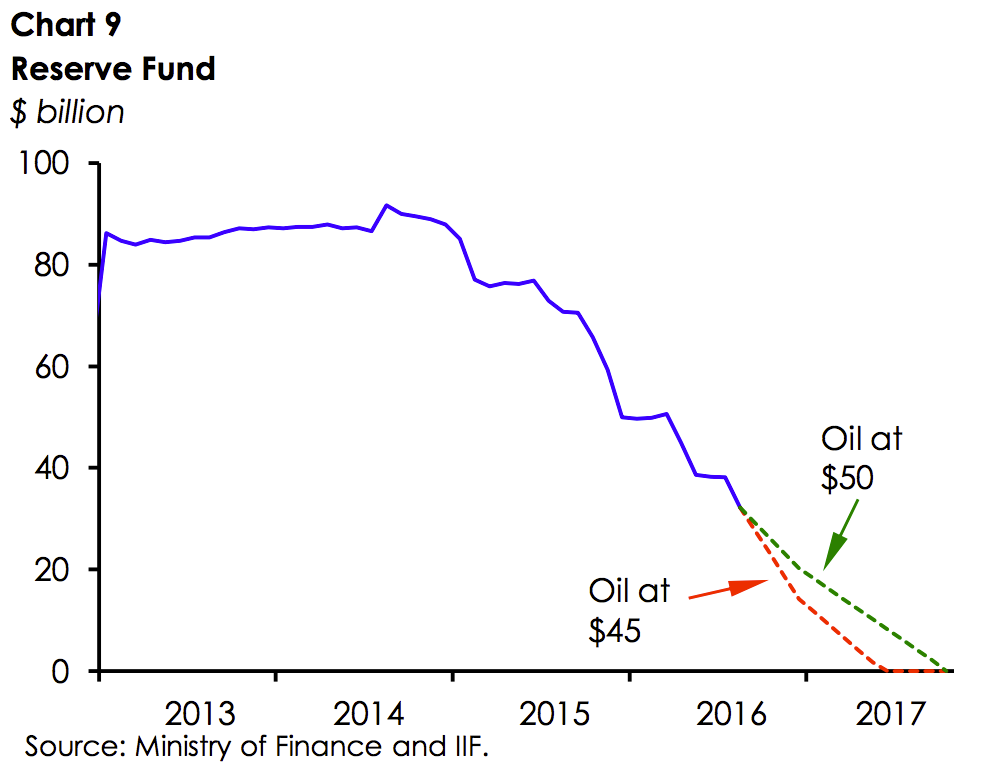

Summary: The Russian reserve fund runs out in 2017.

Why this gets my attention: Russia has been maintaining its federal budget by draining their reserve fund. Their presidential election is in March 2018.

A few notes from the article:

- In 2014 the fund was 67 billion pounds.

- It is now 23 billion pounds ($30.6 billion)

- Federal budget was based upon a $50 a barrel price of oil.

- Average price in January-August has been only $42.70 a barrel (it is currently around $46).

- The budget assumed 1% GDP real growth this year (it has been in decline).

- Export duties on oil was 4% of GDP in 2011

- Was 2% last year

- Now is 1.1% for January-July

- Kicker summary: “With real GDP growth averaging only 0.3% since 2008….the Russian economy has already experienced a lost decade. It needs to implement radical changes if it is not to repeat weak performance in years to come.”

I suspect this “lost decade” is going to be very much a part of Putin’s legacy, where instead of actually growing the economy, the Russian leadership instead comfortably rested on the high oil prices to boost their economy and federal budget and let the rest of the economy languish. People were not that far from the mark when they referred to Russia as being “Nigeria with snow.” To date we have not seen any real efforts to change and adjust the economy, including eliminating the widespread corruption and matching the budget to reflect their revenue. Instead the government has been depleting its reserve fund to cover its budget shortfalls. This cannot last forever. It does remind me of the Soviet days, when they had a huge reserve of gold that had been built up over decades. By the end of the 1980s, they had exhausted this, much to everyone’s surprise.