The Russian economy this last year shrunk 3.7% according to their own figures (the Ukrainian economy is also not doing very well). Just to put this in context, in 2009, during the worst economic year in the United States since the Great Depression, the U.S. economy shrunk 2.8% (and it only grew 0.3% in 2008 as the recession kicked in according to World Bank figures). United States unemployment figures rose from 4.7% in November 2007 to 10% in October 2009. The “Great Recession” officially ended in July 2009 and the economy grew 2.5% in 2010. The U.S. economy in 2014 grew 2.4% and the unemployment rate has just recently dropped to below 5%. Some people are saying that is too slow. Still, this provides context for a 3.7% contraction feels like. The Russian unemployment rate in 2014 was 5.4%.

The Russian economy was not a power house to begin with, being in 2014 only the tenth largest economy in the world, ranked just above Canada and just below India. Its economy was around one-tenth the size of the U.S. economy in 2014 ($17,348,071 million for the U.S. vice 1,860,597 for Russia according to United Nations). The U.S. economy constitutes something like 23-24% of the gross world product. With the current contraction, Russia’s economy may become smaller than Canada’s. Not sure this qualifies Russia as a world power, even with nukes.

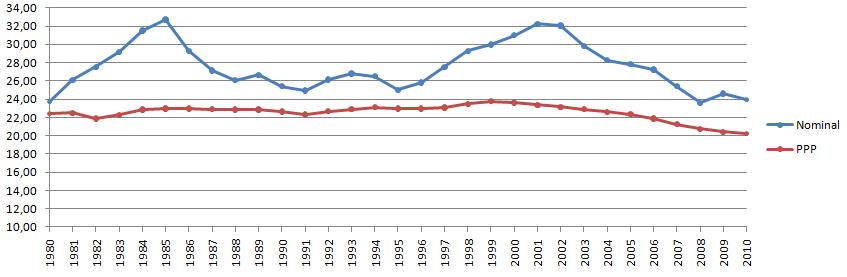

U.S. Share of World GDP (%) since 1980

U.S. Share of World GDP (%) since 1980

It does not appear that this is the end of it. With oil down to $30 a barrel from a height of around $100, with China’s economy slowing down, with more oil coming to the market place due to the release of sanctions on Iran, it is expected that oil will remain below $40 a barrel for some time to come. Gas and oil make up something like 50% of the Russian government revenue (they have a 13% flat income tax). This is creating a massive economic and budget shortfall at a time when they are building up their military and engaged in activities in Ukraine and Syria. Of course, the Russian government has a lot of other expenditures besides defense. It is an interesting balancing act.

The Russian economy is expected to decline in 2016 also, although probably not as much as it did in 2015. The ruble has dropped precipitously compared to the dollar and Euro over the last couple of years (from below 30 to around 80 rubles per dollar). With trade sanctions still in place, Russia’s generally poor relations with most nations in Europe and the west, the Chinese economy slowing down, and oil prices remaining low; there is little reason to expect an immediate turn around.

The Russian recession is clearly deeper and probably will be longer than the U.S. “Great Recession.” But, while our recession lasted around a year and a half (2008 – 2009) and recovery has been slow, the Russian recession is clearly going to last longer. How much longer, we do not know. This is a potentially very long recession for them, and not surprising, this raises questions about internal political stability.